Corporate income tax in Malaysia is applicable to both resident and non-resident companies. With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than.

Tutorial 1 Company Taxation Question Abc Sdn Bhd Chegg Com

Companies are taxed at the 24 with effect from Year of Assessment 2016 while small-scale companies with paid-up capital not exceeding RM25 million are taxed as follows.

. Income tax rates. Lee arrived in Malaysia on 1 June 2010 and. Tax Rate Of Company.

5 Under the self-assessment system an assessment is deemed to have been made by the Director General of Inland Revenue on the date the tax return is submitted The above statement is. Return Form RF Filing Programme. Computation of income tax format in excel for fy 2017 18.

Return Form RF Filing Programme For The Year 2021 Amendment 42021. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Commencing with the profit before tax compute the chargeable income of Uni Sdn Bhd for the year of assessment 2014.

Corporate - Taxes on corporate income. The current CIT rates are provided in the following table. The companys chief financial officer was informed by the tax agent that the company can make two revisions to its tax estimate for the year of assessment 2010 in the sixth month ie.

Which of the following is an accurate description of the above statement made by the tax agent. A business owner and individual who running a business registering business with SSM Enterprise Sole Proprietor and have tax number OG with LHDN. Just proceed to submit your requirements here.

It sets out the commercial decisions taken by the company and its shareholders at the different stages in the. October 26 2021 Post a Comment You fill in the order form with your basic requirements for a paper. Headquarters of Inland Revenue Board Of Malaysia.

33 taxable income and rates. The Malaysia Tax Calculator can help you calculate Profit Loss accounts deduct all allowable expenses deduct tax relief given by the government prevent you from claim unallowable expenses. Contoh Format Baucar Dividen.

For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. Income attributable to a Labuan business. Tax Rate of Company.

A False B True. 30 marks 7 PTO. It is important to note that the burden of computing tax liabilities accurately is on the company and accordingly tax payers are expected to compute taxes while obeying taxation laws and guidelines issued by the Malaysian Inland Revenue Board IRB.

A True B False C True only for companies D True only for individuals and non-corporates 6 Lee is a Canadian employed by a Malaysian company. Company Tax Computation Format Malaysia 2020 - Company Tax Computation Format 1. You can also get a tax year overview.

June 2010 and in the ninth month ie. Not only has the corporate tax rate been decreased over the years the government has also given SMEs a special rate of 17 on the first RM500000 chargeable income for YA 2019. Malaysia Corporate Income Tax Calculator for YA 2020 Assessment of income in Malaysia is done on a current-year basis.

20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. You should indicate by the use of the word nil any item referred to in the question for which no adjusting entry needs to be made in the tax computation. Following the Budget 2020 announcement in October 2019 the reduced rate.

The form c is a declaration form for a company to declare its income whereas tax computation is a statement showing the adjustments to the net profitloss as per the accounts of a company to arrive at the amount of income that is. The corporate tax rate has decreased from 40 in the late 1980s to the current rate of 24. Example of Tax Computation Format Would Be.

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates. Regulation in network and service sectors 2018.

Acc 2241 Format For Chargeable Income Acc 2241 Taxation 1 Computation Of Chargeable Income And Tax Studocu

Format Computation Of Company Tax Format Computation Of Company Tax Format Computation Of Company Studocu

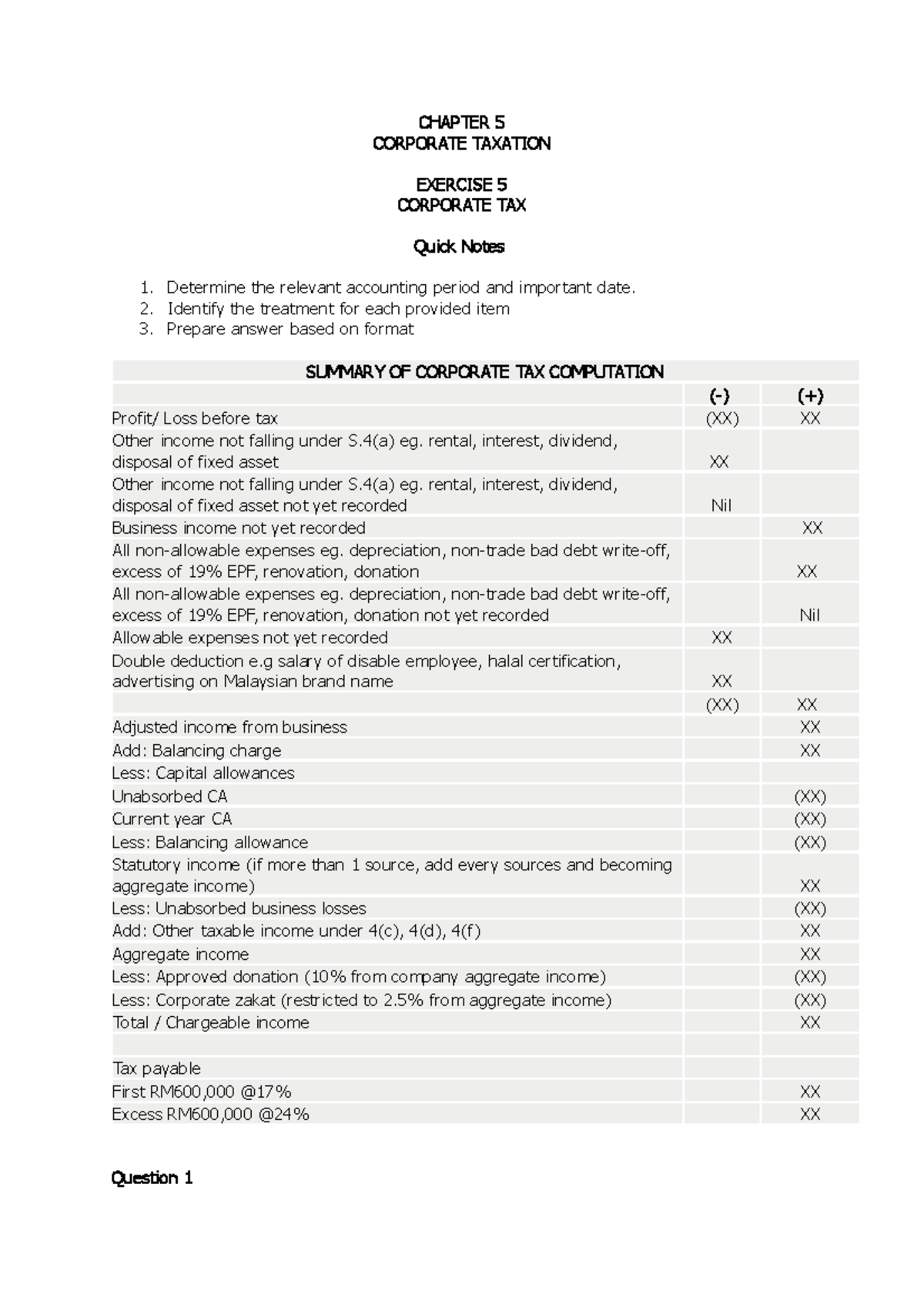

Chapter 5 Tutorial Taxation Chapter 5 Corporate Taxation Exercise 5 Corporate Tax Quick Notes Studocu

Format Computation 1 Xlsx Computation Of Chargeable Income Tax For Ya Xxxx Husband Wife S 4 A Business Income Adjusted Income Add Balancing Course Hero

Company Tax Computation Format

Computation Format For Individual Tax Liability For The Year Of Assessment 20xx Pdf Expense Tax Deduction

Malaysia Taxation Junior Diary Non Income Producing Dormant Inactive

Company Tax Computation Format

Chapter 8 Business Expenses And Tax Computation For Companies Chapter 8 1 Business Expenses And Tax Computation For Companies Companys Course Hero

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

Computation Format For Individual Tax Liability For The Year Of Assessment 20xx Docx Computation Format For Individual Tax Liability For The Year Of Course Hero

Tax Computation Format Lessor Company Name Computation Of Chargeable Incom For Ya Xxxx Rm Leasing Business Gross Income Less Wholly Exclusively Course Hero

Company Tax Computation Format 1

Joint And Separate Assessment Acca Global

Malaysia Tax Computation Format Fill Online Printable Fillable Blank Pdffiller

Format For The Computation Of Business Income Tax 267 Business Income Format Format For The Studocu

Format Employment Income Ya 2020 Name Of The Tax Payer Computation Of The Employement Income For Studocu